Global accounting giant KPMG have released their annual survey of motor industry insiders, summarizing their findings as “The world is moving from car ownership to car usership”, a perhaps not surprising assessment given the general trend to mass public transport, city dwelling, and the rollout of personal public transport as used at major airports.

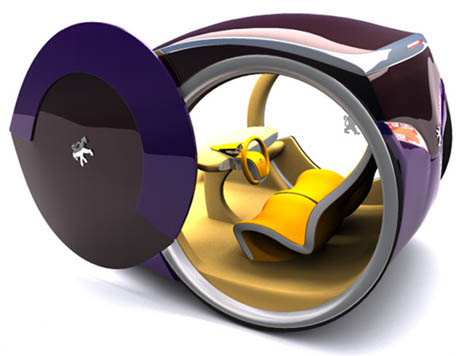

Citing responses from their survey, KPMG state there is a perception within the auto industry that tomorrow’s drivers won’t want to drive at all, and will be even less interested in owning their vehicle. Prevailing opinion is that drivers will become passengers in self-driven vehicles, thus freeing up time to catch up on emails, read the news, or use the built-in connectivity for video chatting with friends.

If this future eventuates, major carmakers could find themselves facing new competition from IT-based companies that have better access to software developers and mapping tools. Certainly corporations like Google and IBM have been active in testing driverless technology with existing vehicles, but how long will it be until they start designing their own cars.

With changing uses of automobiles, the question will be raised, are traditional carmakers capable of adapting to please the market, or will they need to start partnering with IT companies and smaller niche design workshops to retain their market dominance?

At the same time, designers are asking if internal combustion engines are suitable in cars that will need to be precisely controlled by artificially aware drivers. Future success will likely demand alternative power generation for vehicles from the biggest manufacturers who already have economies of scale.

Electric vehicles are expected to become the dominant form of motoring in the coming decades, and already some major carmakers such as Ford, Chevrolet, Toyota, Nissan, Mitsubishi, Honda amongst the first to bring a vehicle to dealer showrooms.

Lighter weight bodies and vehicle trim will be required for electric motors, failing which, batteries will remain large and wasteful, thus reducing usefulness as charge times necessarily remain high. Some designers have hoped for hydrogen powered cars, but with faster advances in battery technology and carbon fiber bodies coming into mainstream, electric vehicles seem to be winning the race.

Some designers have hoped for hydrogen powered cars, but with faster advances in battery technology and carbon fiber bodies coming into mainstream, electric vehicles seem to be winning the race.

New developments in energy recapture from brakes, and less need for heavy power steering systems as vehicles transition to driverless mode means electric vehicles, or vehicles with electric power trains, will be standard.

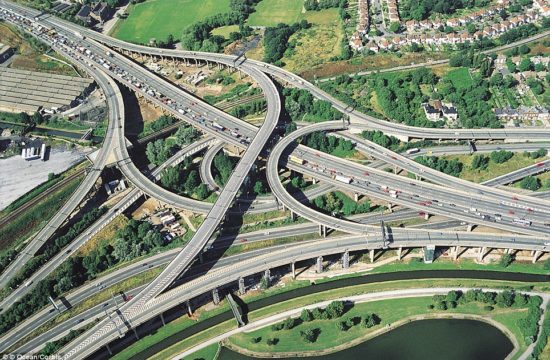

Most significantly, the further trend to megacities, higher traffic congestion, and street parking bans is fueling demand, presently unmet except by taxi, for car users to hail and ride, rather than invest in expensive garage places and ongoing vehicle insurance.

Demographically more than 50% of the world’s population now live in cities, this number is rising, and huge megacities such as Tokyo, New York, Shanghai, Lagos are making changes to vehicle design an imperative.

However, with traffic congestion being an issue, and too few parking spaces being available, there is some speculation car manufacturers may need to expand their leasing divisions and offer car usership with sharing of vehicles for people not able or willing to buy.

However, with traffic congestion being an issue, and too few parking spaces being available, there is some speculation car manufacturers may need to expand their leasing divisions and offer car usership with sharing of vehicles for people not able or willing to buy.

Car companies would in effect become both manufacturers and service providers. KPMG coin the phrase “intelligent mobility services”, which would include a driverless vehicle leased for a time slot, internet connectivity suitable for video streaming and browsing, and journey planning.

Driverless vehicles bring their own challenges and opportunities, not least is where to store them and how to hail them, with smartphone apps or partnerships with mobile phone companies being the two obvious solutions, leading to KPMG speculating that demand from motor companies for prime curbside real estate for short term parking or pickup and drop-off points.

Executives in the automotive industry have begun to realize that with or without driverless vehicles, more people are demanding ‘always on’ connectivity, and as vehicles enter production with more safety features such as road ahead awareness, available parking spots, traffic adjusted speed etc we can expect integrated passenger connectivity to be provided as well.

All of this implies more complex industries, the question is will automakers become vertically integrated corporations buying up niche suppliers to compete against each other, or will they prefer partnerships that are more fluid?

What will happen to barriers of entry into the automotive market, will smaller niche manufacturers be able to stay independent, or could a new paradigm evolve where smaller manufacturers, property investors, and software designers partner up? A raft of new players are poised to enter the market, notably from developing countries like China and India.

Globally these manufacturers haven’t yet flexed their muscles and are known for producing cars based on older western models, but as happened with Eastern European manufacturers, so too will it happen with developing world producers, they will begin to employ their own designers, and compete in the same space as American, Japanese, and European carmakers.

To date the bigger existing carmakers have kept new technology development in-house, buying in expertise when needed or employing graduate engineers and training them up, particularly when it comes to emissions, noise, monocoque design, brakes, steering. It seems reasonable to assume established carmakers would prefer to continue in-house development.

Exactly what this means for the industry in the next few decades is a matter of opinion, yet it can’t be denied innovative approaches to motoring are being seen outside of traditional carmaking. Suppliers and inventors of technologies needed for electric cars for example carbon fiber and battery technology are also realizing that close partnerships with larger corporations may in fact not be in their best interests.

Expect to see more cooperation between design or engineering studios and carmakers and spare parts suppliers. In this new urban reality, carmakers are discovering old paradigms no longer work as well as they did, and a younger generation is more comfortable with an iphone in their hand than a steering wheel.

Industry executives have a steep learning curve ahead of them if they aim to keep their companies relevant in the 21st century, and for the first time, some may face serious tests of viability as they rush to introduce electric or alternatively powered vehicles to a market hungry for change.